So says Ryan Sean Adams, founder of a crypto investment company Mythos Capital. He is citing stats from Mike McDonald, creator of Maker Tools.

In an interesting recent article, McDonald says 3,270 Collateralized Debt Positions (CDPs) have opened on DAI since it launched on December 17th 2017.

A CDP is basically a loan with eth put down as a security for the loan. So if you can’t pay back the money, the smart contract just sells your eth. Making it somewhat similar to home-backed loans where if you can’t pay back the bank, they sell your house.

That means CDPs can be a risky business, but only if you lack discipline and overextend yourself considerably. Otherwise it can be a way to unlock liquidity in your eth while still keeping all your eth. That’s by say borrowing $1,000 in DAI and when you get your monthly wages you pay it back.

“The MakerDAO project is incredible. Little known fact, SpankChain holds 1.5% of all the DAI,” says Ameen Soleimani, CEO of an adult entertainment dapp called SpankChain.

1.5% of DAI’s current $50 million market cap makes it $750,000. That’s a lot of money which hopefully won’t get spanked by being wiped or bitten, new words for older terms of getting margin called, as in the DAI bank asking for its money back.

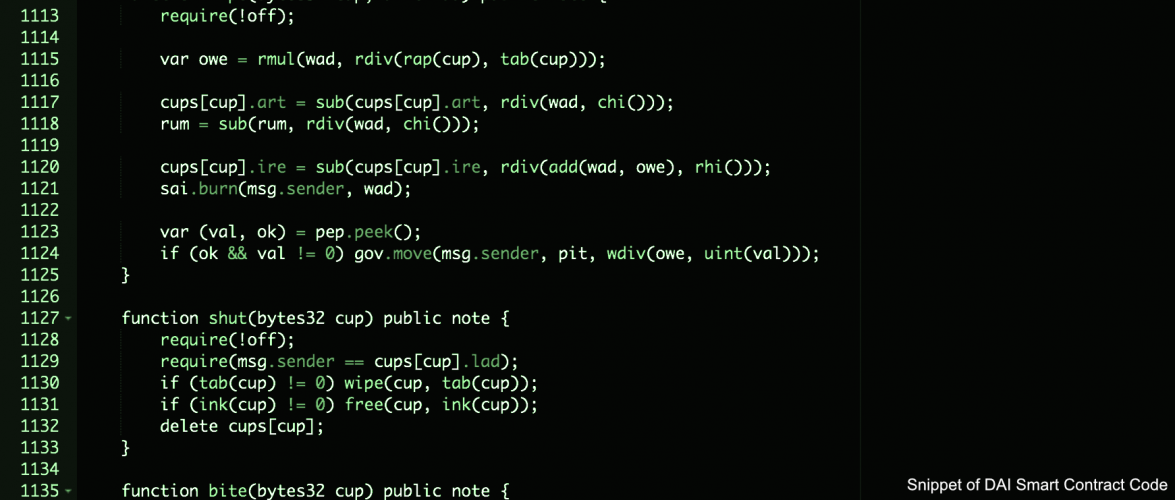

This bank has no offices, no customer support, no employees and its not human. Alien to many its code may be with such words as cup (CDP), art (debt), axe (liquidation fee) and mat, who is not your cheeky high-school friend, but the liquidation ratio.

Through this code of 1,737 lines in the smart contract, your ethereum deposit is turned into dollars with no questions asked, no forms completed, no proof required, and at almost no interest rate or fees.

What is even more amazing than all of the above is the fact that this has not been hacked. The billions of people, the leet haxors, the hidden geniuses roaming in our streets, even the aliens of the universe, not one person or thing has been able to grab this $50 million which sits there in the open for taking if one could but find a little loop in the code.

That they haven’t is a miracle of intellect, and that this beauty has not vanished in days but has stood for months is undoubtedly one of the miracle of our ages.

Modern Art.

That means if this is hacked, no one should be surprised. We’re kind of expecting it, every second on edge to learn what happened. Yet the news has not arrived for now nine months, and that is surprising.

Surprising because we were told smart contracts are hackable, and yet here we have 2,000 lines of unhackable code. That means if unhackable code can be written, then the revolutionary promises of smart contracts are actually real.

Just as one example, algorithmic bank services for humans are perhaps not that necessary as perhaps we can put up with the annoyances of the old bankers. Yet bank services for machines are currently impossible unless natively digital money and smart contracts are used.

As the bot or the machine would need nothing external to tap into DAI, would need not talk to humans or anything like that, would be able to “talk” in its own native language, code, well the bot now can go around shopping for our halloween costume.

DAI moreover is somewhat special because its monetary qualities means it has inbuilt incentives for people to refine it, to build on it, to use it, and to in effect scalp any little difference in prices or utilize any money making avenue that arbitrage or any other opportunity may provide.

Making this an open permissionless platform on top of an open permissionless platform with one of its use case among many potentially being the offering of banking services to crypto projects.

“We will continue to use DAPPs and web3 technology whenever possible. Today we started giving employees the option of getting payed in DAI we have drawn from a CDP.”

So says Martin Köppelmann of prediction market Gnosis. He doesn’t mention how much they have paid their employees in natively digital dollars (DAI), but if you’re a cryptonian you can imagine you’d prefer at least some of your wages, say 10%-20%, in DAI, because you can easily move that around intertubes while you might have to wait quite a bit and pay quite a bit in fees to Coinbase your analogue fiat.

In addition, if a sizable number of such employees have DAI in their possession, merchants would probably want it, exchanges would probably want to provide conversion pipelines, more projects would probably collateralize their funds rather than turning them into snail-speed national fiat, and the world would have gradually become a bit more efficient and convenient.

For now, however, DAI is still a little baby, so it has to grow slowly, learn to walk and then maybe run. Because we are, afterall, still waiting for that noob to maybe freeze all the DAI eth or for some genius to bend the code.

If they really don’t come, then the world would automatically change for a revolutionary concept would have proven itself.

Copyrights Trustnodes.com